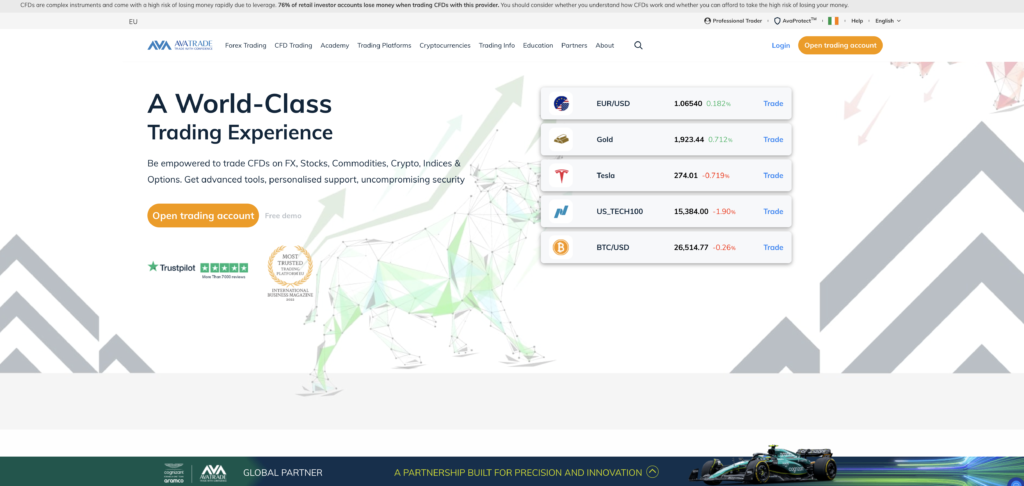

AvaTrade is a regulated broker in South Africa that offers a wide range of trading instruments and services. They provide a secure and transparent trading environment, making it an attractive choice for South African traders. In this genuine review, we will delve into the various aspects of AvaTrade, including their trading platforms, account types, fees, regulation measures, tradable assets, deposit and withdrawal methods, mobile trading experience, technical analysis tools, and more. By the end of this article, you will have a comprehensive understanding of AvaTrade and be empowered to make informed trading decisions.

Key Takeaways:

- AvaTrade is a regulated broker in South Africa, ensuring a safe trading environment.

- They offer a wide range of trading instruments, including Forex, CFDs, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies.

- AvaTrade provides multiple trading platforms, including MT4, AvaTradeGo, and AvaOptions.

- They have different account types to suit traders with varying experience levels.

- AvaTrade offers competitive spreads, no deposit or withdrawal fees, and transparent trading costs.

Now, let’s dive into the details of AvaTrade and explore what makes them a top choice for South African traders.

AvaTrade Broker Overview

AvaTrade is a well-regulated broker in South Africa that provides a wide variety of trading instruments and services. Traders can access a diverse range of markets, including Forex, CFDs, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies. This allows them to diversify their portfolios and take advantage of different investment opportunities.

One of the key advantages of trading with AvaTrade is the availability of multiple trading platforms. Traders can choose from popular platforms like MT4, which offers advanced charting tools and automated trading capabilities. Additionally, AvaTrade has developed its own proprietary software, AvaTradeGo, which provides a user-friendly interface and allows traders to access their accounts on the go. For those interested in options trading, AvaOptions offers a comprehensive platform for trading vanilla options.

In terms of fees, AvaTrade offers competitive spreads and charges no deposit or withdrawal fees. This helps traders keep their trading costs low and maximize their potential profits. The minimum deposit required to open an account is $100, making it accessible to traders of all levels.

Trading Instruments and Services

| Trading Instruments | Trading Services |

|---|---|

| Forex | Commission-Free Trading |

| CFDs | Multiple Deposit and Withdrawal Methods |

| Stocks | Mobile Trading Experience |

| Commodities | Technical Analysis Tools |

| Indices | 24/5 Customer Support |

| ETFs | Regulation and Safety |

| Bonds | Wide Range of Tradable Assets |

| Cryptocurrencies | Transparent Trading Fees |

AvaTrade is a regulated broker and is considered safe for traders. They adhere to strict regulatory standards and client funds are held in segregated accounts. This provides an added layer of security for traders, knowing that their funds are kept separately from the broker’s own finances.

In conclusion, AvaTrade provides South African traders with a reliable and wide-ranging trading experience. From their selection of trading instruments to their user-friendly platforms and competitive fees, AvaTrade offers a comprehensive trading solution. While there are some drawbacks such as the lack of FSCA protection for South African clients and slower withdrawal processing times compared to other brokers, the overall offerings and features make AvaTrade a reputable choice for traders looking to delve into the financial markets.

AvaTrade Trading Platforms

AvaTrade offers multiple trading platforms, including industry-leading options like MT4, AvaTradeGo, and AvaOptions. These platforms provide South African traders with a diverse range of features and tools to enhance their trading experience.

MT4

MT4 is widely recognized as one of the most popular trading platforms in the industry, known for its user-friendly interface and extensive technical analysis capabilities. Traders can access a wide range of trading instruments and utilize advanced charting tools, indicators, and expert advisors to make informed trading decisions.

AvaTradeGo

AvaTradeGo is a proprietary mobile app developed by AvaTrade, offering traders the flexibility to trade on the go. With its intuitive design and user-friendly interface, traders can easily access their accounts, execute trades, and monitor their positions from their smartphones or tablets. AvaTradeGo provides real-time market updates, advanced charting tools, and a variety of order types to suit different trading strategies.

AvaOptions

AvaOptions is a powerful platform specifically designed for trading vanilla options. It allows South African traders to manage risk and explore new trading opportunities in the options market. With AvaOptions, traders can customize their options strategies, access real-time options prices, and utilize advanced risk management tools to optimize their trading performance.

Overall, AvaTrade’s trading platforms offer a comprehensive suite of features and tools to cater to the diverse needs of South African traders. Whether you prefer the desktop functionality of MT4, the convenience of mobile trading with AvaTradeGo, or the versatility of trading vanilla options with AvaOptions, AvaTrade has you covered.

AvaTrade Account Types

AvaTrade offers a range of account types to suit the needs of different traders. Whether you are a beginner or an experienced trader, AvaTrade has options that cater to various trading styles and preferences. Below, we will explore the different account types available at AvaTrade, along with their features and benefits.

1. Retail Account

The Retail Account is designed for individual traders looking to start their trading journey. With a minimum deposit of $100, this account provides access to a wide range of trading instruments, including Forex, CFDs, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies. Retail Account holders can benefit from competitive spreads, no deposit or withdrawal fees, and commission-free trading. It is an excellent choice for those who want to explore different markets and enjoy flexibility in their trading strategies.

2. Professional Account

The Professional Account is suitable for experienced traders who meet specific criteria set by AvaTrade. Traders with a Professional Account can enjoy additional benefits, including higher leverage, access to exclusive market analysis and research, dedicated account managers, and priority customer support. To be eligible for a Professional Account, traders must meet specific requirements in terms of trading experience, trading volume, and financial knowledge. This account type allows experienced traders to maximize their trading potential and take advantage of advanced trading features.

3. Islamic Account

AvaTrade also offers Islamic Accounts, which comply with Shariah law and are designed for Muslim traders who want to trade in compliance with their religious beliefs. Islamic Accounts are swap-free, meaning there are no overnight interest charges on positions held for more than 24 hours. This account type ensures that traders can participate in the financial markets while adhering to Islamic principles. With the Islamic Account, traders have access to the same range of trading instruments and features as other account types, making it a suitable option for Muslim traders.

| Account Type | Minimum Deposit | Key Features |

|---|---|---|

| Retail Account | $100 | Wide range of trading instruments, competitive spreads, commission-free trading |

| Professional Account | Criteria-based | Higher leverage, exclusive market analysis, dedicated account managers |

| Islamic Account | $100 | Swap-free trading, compliance with Shariah law |

When choosing an account type, it is essential to consider your trading goals, experience level, and risk tolerance. AvaTrade’s range of account types provides flexibility and tailored options, allowing traders to find the account that best suits their needs.

AvaTrade Fees and Spreads

AvaTrade offers competitive spreads and transparent trading fees, making it a cost-effective choice for traders. With this broker, you can enjoy tight spreads across a wide range of trading instruments, including Forex, CFDs, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies.

To give you an idea of their spreads, let’s take a look at a selection of popular trading instruments:

| Instrument | Typical Spread |

|---|---|

| EUR/USD | 2 pips |

| Apple (AAPL) | 0.03 USD |

| Gold (XAU/USD) | 0.31 USD |

| Bitcoin (BTC/USD) | 76 USD |

In addition to competitive spreads, AvaTrade is known for its transparent and fair trading fees. There are no deposit or withdrawal fees, allowing you to freely manage your funds without any hidden costs. This makes it easier for you to calculate and optimize your trading costs.

It’s worth noting that while AvaTrade offers competitive spreads and transparent fees, trading costs can vary depending on market conditions and the specific trading instrument. As with any broker, it’s important to carefully consider your trading strategy and the potential costs involved.

Overall, AvaTrade provides traders with a cost-effective trading environment, allowing you to efficiently manage your expenses and maximize your trading profits.

AvaTrade Regulation and Safety

AvaTrade is a well-regulated broker, providing a safe trading environment for clients. As a regulated broker in South Africa, AvaTrade operates under the oversight of the Financial Sector Conduct Authority (FSCA). This regulatory body ensures that AvaTrade adheres to strict industry standards and guidelines, promoting transparency and trust in the financial markets.

Client funds are held in segregated accounts, separate from the company’s operational funds. This means that even in the unlikely event of AvaTrade’s insolvency, client funds remain protected and cannot be used for any other purposes. This segregation of funds provides an additional layer of security, giving South African traders peace of mind when trading on the AvaTrade platform.

In addition to the FSCA regulation, AvaTrade is also subject to regulation by several other reputable financial authorities around the world. These include the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), and the Financial Services Agency (FSA) in Japan. This multi-regulatory approach further reinforces the broker’s commitment to maintaining the highest standards of safety and compliance.

Client Fund Protection and Compensation Scheme

AvaTrade takes the security of client funds seriously. In the event of the broker’s insolvency, clients may be eligible for compensation under the Investor Compensation Scheme. The scheme provides coverage up to a certain limit, offering an additional layer of protection for South African traders.

| Regulatory Authority | Compensation Scheme | Maximum Compensation |

|---|---|---|

| Financial Sector Conduct Authority (FSCA) | Investor Compensation Scheme | R5 million |

| Central Bank of Ireland | Investor Compensation Scheme | €20,000 |

| Australian Securities and Investments Commission (ASIC) | National Guarantee Fund | AUD $250,000 |

| Financial Services Agency (FSA) Japan | Investor Protection Fund | JPY ¥10 million |

AvaTrade prioritizes the safety and security of its clients’ funds, ensuring regulatory compliance and providing protection through segregated accounts and compensation schemes. This commitment to client fund protection sets them apart as a trustworthy broker in the industry.

Overall, AvaTrade’s commitment to regulation and safety, along with the protections and compensation schemes in place, make it a reliable choice for South African traders who prioritize the security of their funds.

AvaTrade Tradable Assets

AvaTrade offers a diverse range of tradable assets, including specialty instruments like vanilla options. Traders can access a variety of financial markets, allowing them to diversify their portfolios and take advantage of different trading opportunities.

One of the key offerings from AvaTrade is their extensive selection of currency pairs in the Forex market. Traders can choose from major, minor, and exotic pairs, providing ample opportunities to capitalize on global currency fluctuations.

In addition to Forex, AvaTrade also provides access to a wide range of CFDs (Contracts for Difference). Traders can trade CFDs on popular stocks, indices, commodities, ETFs, and bonds, allowing them to profit from price movements in these underlying assets without actually owning them.

| Asset Class | Examples |

|---|---|

| Forex | EUR/USD, GBP/USD, USD/JPY |

| Stocks | Apple, Microsoft, Amazon |

| Indices | S&P 500, NASDAQ, FTSE 100 |

| Commodities | Gold, Oil, Natural Gas |

| ETFs | SPDR S&P 500 ETF, iShares MSCI Emerging Markets ETF |

| Bonds | US Treasury Bonds, German Bunds |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin |

For those looking to explore more advanced trading strategies, AvaTrade offers specialty instruments like vanilla options. These options provide traders with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and within a specified timeframe. This gives traders the opportunity to profit from both rising and falling markets, and adds another layer of diversification to their trading activities.

Overall, with a wide range of tradable assets, including specialty instruments like vanilla options, AvaTrade provides South African traders with ample opportunities to engage in a diverse and dynamic trading environment.

AvaTrade Deposit and Withdrawal Methods

AvaTrade supports various deposit and withdrawal methods, providing traders with flexibility and convenience. Traders can choose from a range of options to fund their accounts and withdraw their profits. Below, you’ll find a table summarizing the available methods:

| Method | Availability | Processing Time |

|---|---|---|

| Bank Wire Transfer | Available | 3-5 business days |

| Credit/Debit Cards | Visa, Mastercard, Maestro, American Express | Up to 24 hours |

| E-Wallets | Neteller, Skrill, WebMoney | Up to 24 hours |

| Bitcoin | Available | Up to 24 hours |

When making a deposit or withdrawal, it’s important to consider the processing times associated with each method. Bank wire transfers may take longer, typically 3-5 business days, while credit/debit cards, e-wallets, and Bitcoin transactions are usually processed within 24 hours. Traders can choose the method that best suits their needs and preferences.

It’s worth noting that some payment providers may charge additional fees for their services. While AvaTrade does not charge any deposit or withdrawal fees, it’s recommended to check with your chosen payment provider for any potential charges on their end.

AvaTrade strives to ensure a smooth and hassle-free deposit and withdrawal process for its clients. The availability of multiple options allows traders to select the most suitable method for their specific circumstances. Whether you prefer traditional bank transfers, credit/debit cards, e-wallets, or even cryptocurrencies like Bitcoin, AvaTrade has you covered.

AvaTrade Mobile Trading Experience

AvaTrade provides a highly rated mobile trading experience, allowing traders to trade on the go. Their mobile trading platform, AvaTradeGo, offers a user-friendly interface and seamless functionality. Traders can access their accounts, monitor market movements, place trades, and manage their portfolios directly from their mobile devices.

The AvaTradeGo app is available for both iOS and Android devices, ensuring compatibility with a wide range of smartphones and tablets. The app is designed to provide a smooth and efficient trading experience, with fast execution and real-time market updates. Traders can easily navigate through different asset classes, analyze charts, and implement various technical analysis tools.

In addition to AvaTradeGo, AvaTrade also offers access to the popular MetaTrader 4 (MT4) platform through mobile devices. MT4 is widely recognized for its advanced charting capabilities, customizable indicators, and automated trading options. Traders can install the MT4 app on their mobile devices and enjoy the same features and functionalities available on the desktop version.

With AvaTrade’s mobile trading experience, traders have the flexibility to monitor their trades and seize opportunities wherever they are. Whether it’s a news event, a sudden market shift, or an emerging trading opportunity, traders can stay connected and act instantly via their mobile devices, ensuring they never miss out on potential profits.

| Key Advantages of AvaTrade Mobile Trading Experience: |

|---|

| 1. User-friendly interface |

| 2. Fast trade execution |

| 3. Real-time market updates |

| 4. Access to technical analysis tools |

| 5. Compatibility with iOS and Android devices |

AvaTrade Technical Analysis Tools

AvaTrade offers a range of technical analysis tools on their trading platforms, empowering traders with insightful data. These tools are essential for making informed trading decisions and maximizing potential profits. With AvaTrade, South African traders can access a variety of technical indicators, charting tools, and customizable analysis features that cater to both novice and experienced traders.

One of the standout technical analysis tools offered by AvaTrade is their integration with the popular MetaTrader 4 (MT4) platform. MT4 is renowned for its extensive range of indicators, including moving averages, oscillators, and trend-following tools. Traders can use these tools to identify market trends, analyze price patterns, and develop effective trading strategies.

In addition to MT4, AvaTrade also provides their proprietary trading platform, AvaTradeGo, which is available for both desktop and mobile devices. AvaTradeGo offers a user-friendly interface that allows traders to access a wide range of technical analysis tools on the go. Traders can create customizable watchlists, set up price alerts, and access real-time market analysis reports, all at their fingertips.

AvaTrade Technical Analysis Tools

| Features | Benefits |

|---|---|

| Wide range of technical indicators | Helps in identifying market trends and patterns |

| Customizable charting tools | Allows traders to personalize their analysis approach |

| Real-time market analysis reports | Keeps traders updated on market conditions and opportunities |

| Integrated economic calendar | Enables traders to stay informed about upcoming economic events |

Traders can also utilize AvaOptions, an advanced options trading platform offered by AvaTrade. This platform provides access to various options trading strategies and includes a range of technical analysis tools specifically designed for options traders. Traders can analyze volatility, assess pricing models, and execute options trades with ease.

In conclusion, AvaTrade offers a comprehensive suite of technical analysis tools across their trading platforms, catering to the diverse needs of South African traders. These tools enable traders to perform in-depth analysis, identify profitable opportunities, and make well-informed trading decisions. Whether you prefer MetaTrader 4, AvaTradeGo, or AvaOptions, AvaTrade provides the tools you need to navigate the financial markets with confidence.

AvaTrade Pros and Cons

AvaTrade has several advantages, but there are also some drawbacks to consider when choosing this broker for your trading needs. Let’s take a closer look at the pros and cons of trading with AvaTrade:

Advantages of AvaTrade:

- A wide variety of trading instruments are available, including Forex, CFDs, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies. This provides ample opportunities for diversification and trading in different markets.

- AvaTrade offers multiple trading platforms, including the popular MetaTrader 4 (MT4) platform, as well as their own proprietary software called AvaTradeGo and AvaOptions. This gives traders flexibility in choosing the platform that best suits their needs.

- The minimum deposit required to open an account with AvaTrade is $100, making it accessible to traders with different budget sizes.

- Competitive spreads are offered, allowing traders to enter and exit positions at favorable prices. Additionally, AvaTrade does not charge any deposit or withdrawal fees, making it cost-effective for traders.

- AvaTrade is a regulated broker, providing a level of safety and security to clients. They are regulated in South Africa by the Financial Sector Conduct Authority (FSCA) and follow strict regulatory guidelines to protect client funds.

- There is a wide range of tradable assets available on the AvaTrade platform, including specialty instruments like vanilla options. This enables traders to explore different markets and investment opportunities.

- Commission-free trading is offered by AvaTrade, removing the burden of extra costs for traders. Additionally, they provide transparent trading fees, ensuring that traders are fully aware of the costs involved.

- AvaTrade supports various deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. This provides convenience and flexibility for traders to manage their funds.

- The mobile trading experience provided by AvaTrade is highly rated, with a user-friendly interface and comprehensive functionality. Traders can access their accounts and trade on the go with ease.

Drawbacks of AvaTrade:

- One drawback to consider is that AvaTrade does not offer protection from the Financial Sector Conduct Authority (FSCA) for South African clients. This means that in the event of any disputes or issues, clients may not have recourse to local regulatory authorities.

- Another drawback is that withdrawal processing times at AvaTrade may be slower compared to some other brokers. This may affect the speed at which traders can access their funds.

Overall, AvaTrade is a reputable broker that offers a range of features and benefits to traders. However, it is important to weigh the pros and cons mentioned above to make an informed decision based on your individual trading needs and priorities.

Evest, an emerging market maker broker, has become a favored choice for many traders, thanks to its expansive offerings and user-friendly features.

Join AvaTrade today and leverage the power of a world-class trading platform. Experience vast asset choices, top-tier tools, and unparalleled security!

Dive into the world of trading with IG – a leader in forex and CFD trading. Experience advanced platforms, vast educational resources, and a global reputation of trust.

Trade seamlessly with CMTrading! Dive into a world of diverse assets with top-notch security protocols and unmatched support.

AvaTrade Comparison with Other Brokers

In comparison to other brokers, AvaTrade stands out as a reliable choice for South African traders with its competitive features and fees. With a range of trading instruments including Forex, CFDs, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies, AvaTrade offers diverse investment opportunities to suit various trading strategies.

When it comes to trading platforms, AvaTrade provides multiple options like MT4, MT5, and their own proprietary software, AvaTradeGo. These platforms are known for their user-friendly interfaces and access to advanced technical analysis tools, enabling traders to make well-informed decisions.

The minimum deposit requirement of $100 makes AvaTrade accessible to traders of all levels. Additionally, they offer competitive spreads and do not charge any deposit or withdrawal fees, making trading more cost-effective for their clients.

| AvaTrade | Other Brokers | |

|---|---|---|

| Minimum Deposit | $100 | Varies |

| Spreads | Competitive | Varies |

| Deposit/Withdrawal Fees | No fees | Varies |

| Regulation | Regulated and considered safe | Varies |

| Tradable Assets | Wide range including specialty instruments | Varies |

| Mobile Trading Experience | Highly rated | Varies |

It’s important to note that while AvaTrade is well-regulated and holds client funds in segregated accounts, it does not provide FSCA protection for South African clients. Traders should consider this factor when choosing a broker.

Another aspect to consider is the withdrawal processing times. While AvaTrade ensures the security of funds, some traders have reported slower withdrawal times compared to other brokers. This may be a consideration for those looking for faster access to their funds.

AvaTrade Customer Support

AvaTrade provides reliable customer support to assist traders with any queries or issues. With a dedicated team of knowledgeable professionals, AvaTrade ensures that their clients receive prompt and effective assistance whenever they need it. Traders can reach out to the support team through various channels, including live chat, email, and telephone, making it convenient for South African traders to seek assistance in their preferred mode of communication.

The customer support team at AvaTrade is known for their professionalism and expertise in the field of online trading. They are committed to providing accurate and helpful information, as well as resolving any technical or account-related issues that traders may encounter. Whether it’s a question about the trading platforms, account types, or deposit and withdrawal methods, the support team is always ready to assist, ensuring that traders have a smooth and hassle-free experience.

24/5 Availability and Multilingual Support

One of the standout features of AvaTrade’s customer support is their 24/5 availability. Traders can reach out to the support team from Monday to Friday, ensuring that assistance is readily accessible during the most active trading hours. This availability is especially beneficial for South African traders who operate in different time zones, as they can receive real-time support when the markets are open.

AvaTrade also offers multilingual support, catering to the diverse needs of their global client base. Traders who prefer to communicate in languages other than English can take advantage of the multilingual support, which includes languages such as Spanish, French, Italian, German, and more. This commitment to language accessibility further enhances the customer support experience and ensures that traders can communicate effectively and comfortably.

| Key Features of AvaTrade Customer Support |

|---|

| 24/5 availability |

| Multilingual support |

| Responsive and knowledgeable team |

| Multiple communication channels |

| Experience in addressing technical and account-related issues |

In conclusion, AvaTrade’s customer support is an essential component of their commitment to providing a seamless trading experience for South African traders. With their responsive and knowledgeable team, availability during active trading hours, and multilingual support, AvaTrade ensures that traders can rely on their assistance whenever they need it. Whether it’s clarifying trading concepts, troubleshooting platform issues, or addressing account-related concerns, AvaTrade’s customer support is dedicated to helping traders navigate the world of online trading with confidence.

AvaTrade Withdrawal Processing Times

While AvaTrade offers competitive services, it’s important to note that withdrawal processing times may be slower. As with any broker, the time it takes for funds to reach your bank account can vary depending on several factors, including the payment method used and the processing procedures of the receiving bank. AvaTrade strives to process all withdrawal requests in a timely manner, but external factors beyond their control can sometimes cause delays.

It’s worth noting that bank wire transfers tend to take longer compared to other methods. This is because wire transfers involve multiple intermediary banks, which can add additional processing time. Depending on the bank’s policies and the country of destination, it may take anywhere from a few business days to a week or more for wire transfer withdrawals to be completed.

To provide a better understanding of withdrawal processing times, it’s helpful to refer to the following table:

| Withdrawal Method | Estimated Processing Time |

|---|---|

| Bank Wire Transfer | 3-7 business days |

| Credit/Debit Card | 3-5 business days |

| E-wallets (e.g., Skrill, Neteller) | 1-2 business days |

It’s important to keep in mind that these are approximate estimates and can vary depending on the circumstances. AvaTrade recommends checking their website or contacting their customer support team for the most up-to-date information regarding withdrawal processing times.

Conclusion

In conclusion, AvaTrade is a reputable broker with good features, but it’s important to consider the specific needs and preferences of South African traders before making a decision. As a regulated broker in South Africa, AvaTrade offers a wide variety of trading instruments, including Forex, CFDs, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies. Their multiple trading platforms, including MT4, AvaTradeGo, and AvaOptions, provide traders with a range of options.

AvaTrade’s minimum deposit requirement of $100 makes it accessible to traders of all levels. They offer competitive spreads and do not charge any deposit or withdrawal fees, which is a significant advantage. The broker is well-regulated and considered safe, with client funds held in segregated accounts to ensure their protection.

With a good range of tradable assets, including specialty instruments like vanilla options, AvaTrade caters to the diverse trading needs of its clients. The broker offers commission-free trading and transparent trading fees, allowing traders to make informed decisions. They support various deposit and withdrawal methods, providing convenience and flexibility to their users.

Furthermore, AvaTrade’s mobile trading experience is highly rated, with a user-friendly interface and extensive functionality. Traders can access technical analysis tools on their trading platforms, such as MT4, to enhance their trading strategies.

While AvaTrade has many positive aspects, it’s important to note that South African clients do not have the protection of the Financial Sector Conduct Authority (FSCA), which may be a drawback for some traders. Additionally, withdrawal processing times at AvaTrade may be slower compared to other brokers, which is something to consider.

Ultimately, South African traders should carefully evaluate their trading needs and preferences before choosing AvaTrade or any other broker. It is recommended to compare AvaTrade with other brokers, considering factors such as features, fees, services, and regulatory protection, to make an informed decision that aligns with their individual requirements.

Evest, an emerging market maker broker, has become a favored choice for many traders, thanks to its expansive offerings and user-friendly features.

Join AvaTrade today and leverage the power of a world-class trading platform. Experience vast asset choices, top-tier tools, and unparalleled security!

Dive into the world of trading with IG – a leader in forex and CFD trading. Experience advanced platforms, vast educational resources, and a global reputation of trust.

Trade seamlessly with CMTrading! Dive into a world of diverse assets with top-notch security protocols and unmatched support.

FAQ

Q: Is AvaTrade a regulated broker in South Africa?

A: Yes, AvaTrade is a regulated broker in South Africa.

Q: What trading instruments does AvaTrade offer?

A: AvaTrade offers a wide variety of trading instruments, including Forex, CFDs, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies.

Q: What trading platforms does AvaTrade provide?

A: AvaTrade provides multiple trading platforms, including MT4, AvaTradeGo, and AvaOptions.

Q: What is the minimum deposit required to open an account with AvaTrade?

A: The minimum deposit required to open an account with AvaTrade is $100.

Q: Are there any deposit or withdrawal fees with AvaTrade?

A: No, AvaTrade does not charge any deposit or withdrawal fees.

Q: Is AvaTrade considered safe?

A: Yes, AvaTrade is considered safe, with client funds held in segregated accounts.

Q: Does AvaTrade offer commission-free trading?

A: Yes, AvaTrade offers commission-free trading.

Q: What deposit and withdrawal methods does AvaTrade support?

A: AvaTrade supports various deposit and withdrawal methods, including bank wire transfer, credit/debit cards, and e-wallets.

Q: How is the mobile trading experience on AvaTrade?

A: The mobile trading experience on AvaTrade is highly rated, offering a user-friendly interface and functionality.

Q: What technical analysis tools are available on AvaTrade?

A: AvaTrade provides access to technical analysis tools on their trading platforms, including web trader, MT4, and MT5.

Q: What are the pros and cons of using AvaTrade?

A: AvaTrade has several advantages, such as a wide range of tradable assets, competitive spreads, and good regulation. However, some drawbacks include the lack of FSCA protection for South African clients and slower withdrawal processing times compared to other brokers.