CMTrading Review: Established in 2011 with its headquarters in Johannesburg, this trusted and transparent broker is highly regarded by traders in South Africa. Regulated by the Financial Services Board (FSB) and the Financial Services Authority (FSA), CMTrading ensures the safety and security of client funds.

Key Takeaways of CMTrading Review:

- CM Trading is a reputable broker known for its transparency and trustworthiness.

- Regulated by the FSB and FSA, CM Trading adheres to strict financial regulations to protect client funds.

- CM Trading offers a range of trading platforms, including MT4, PandaTS, and Webtrader, providing traders with the tools they need to execute their trades efficiently.

- Traders can choose from various account types, each with its own features and benefits, catering to the needs of different traders.

- CM Trading provides excellent customer support, with service hours that accommodate traders’ needs.

- Traders have access to a wide range of tradable assets, including forex, cryptocurrencies, CFDs, stocks, and commodities.

- CM Trading has received positive reviews and testimonials from satisfied customers, highlighting their positive experiences with the broker.

- While CM Trading is not available to traders in the United States, it remains a popular choice for traders in South Africa.

CM Trading at a Glance

Founded in 2011, CM Trading is a reputable broker headquartered in Johannesburg, South Africa. It is regulated by the Financial Sector Conduct Authority (FSCA) and the Financial Services Authority (FSA). With a focus on providing a safe and secure trading environment, CM Trading offers a wide range of trading instruments, including Forex, cryptocurrencies, CFDs, stocks, and commodities.

CM Trading’s mission is to create a seamless and technology-driven process for traders, combining years of experience to offer a one-stop destination for online trading. The broker prides itself on competitive fees and spreads, as well as excellent educational material to support traders in their investment journey.

With a trust score of 91 out of 99, CM Trading is considered a low-risk trading platform. The company holds its clients’ funds in segregated accounts to ensure maximum security and peace of mind. In addition, CM Trading has received multiple awards and is recognized as a trusted broker in the industry.

CM Trading Overview

| Broker’s Name | CM Trading |

|---|---|

| Headquartered | Johannesburg, South Africa |

| Year Founded | 2011 |

| Regulating Authorities | FSCA, FSA |

| Countries not accepted for trade | Not indicated |

| Islamic account (swap-free) | Yes |

| Demo Account | Yes |

| Institutional Accounts | Yes |

| Managed Accounts | Yes |

| Maximum Leverage | 1:200 |

| Minimum Deposit | $100 / ZAR R1 600 |

| Deposit Options | Visa card, MasterCard, Bank Wire, EFT, OZOW, Skrill, Neteller, Mpesa, Local Mobile Money, Cryptocurrencies |

| Withdrawal Options | Visa card, MasterCard, Bank Wire, OZOW, Skrill, Neteller, Mpesa, Local Mobile Money, Cryptocurrencies |

| Platform Types | MT4, PandaTS, Webtrader |

| OS Compatibility | Desktop platforms (Windows, Mac), Web platform, Mobile: Android, iOS |

| Tradable assets offered | Currencies, Cryptocurrencies (Bitcoin, Litecoin, Ethereum), CFDs (Gold, Silver, Other) Precious Metals, Stocks, Stock Indexes, Oil, and Other Commodities |

| Languages supported on Website | English, Arabic, and Spanish |

| Customer Support Languages | English, Arabic, and Spanish |

| Customer Service Hours | Weekdays 8am – 9pm, Sunday 9am – 1pm |

Account Types and Trading Conditions

CM Trading offers a variety of account types to cater to the needs of different traders, with competitive fees and spreads. Traders can choose from four different account options: Mini, Classic, Executive, and Premium.

The Mini account requires a minimum deposit of $250 and offers a spread-based trading model. It provides access to daily and weekly market reviews to help traders stay informed.

The Classic account requires a minimum deposit of $1,000 and offers leverage of up to 1:200. It provides regular spreads and includes free access to webinars and one risk-free trade.

The Executive account requires a minimum deposit of $5,000 and offers tighter spreads. Traders with this account also receive two risk-free trades, advanced webinars, and a VIP CMT Prepaid Card for convenient deposits and withdrawals.

The Premium account is designed for professional traders and requires a minimum deposit of $25,000. It offers full-service support, including same day withdrawals, three risk-free trades, and two trading strategies to enhance trading performance.

| Account | Minimum Deposit (USD) | Minimum Deposit (ZAR) |

|---|---|---|

| Bronze Account | $100 | ZAR R1,600 |

| Silver Account | $1,000 | ZAR R16,000 |

| Gold Account | $10,000 | ZAR R160,000 |

| Premium Account | $100,000 | ZAR R1,600,000 |

These account types provide traders with flexibility and choice, allowing them to select the account that best suits their trading style and investment goals. With competitive fees and spreads, CM Trading aims to provide a transparent and cost-effective trading experience for its clients.

Safety and Regulation

CM Trading prioritizes the safety of client funds and operates under strict regulations set by the Financial Services Board (FSB), ensuring peace of mind for traders. The FSB is a reputable regulatory authority that ensures fair and transparent trading in the financial markets.

Client funds at CM Trading are held in segregated accounts, separate from the company’s own funds. This means that even in the unlikely event of the broker’s insolvency, client funds are protected and can be easily returned to the traders.

Furthermore, CM Trading undergoes routine audits to ensure that its financial transactions are fair and honest. The broker is required to keep its financials separate from the funds of its clients, as per FSA regulations. This provides an additional layer of security for traders, as it guarantees that their funds are not being misused by the company.

Regulating Authorities

CM Trading is regulated by the Financial Services Board (FSB), which is the primary regulatory authority in South Africa. The FSB has set stringent guidelines and regulations to ensure a fair and transparent marketplace for all financial companies operating in the country.

Segregated Accounts

Segregated accounts are an essential safety measure for traders. CM Trading keeps client funds in segregated accounts held at reputable financial institutions, such as Barclays PLC and Nedbank. These accounts are separate from the broker’s own operational accounts, providing an added layer of security and ensuring that client funds are protected.

Conclusion

In conclusion, CM Trading places a strong emphasis on safety and regulation, providing a secure and transparent trading environment for its clients. The use of segregated accounts and regulation by the Financial Services Board ensures that traders’ funds are protected and that the broker operates with integrity. Traders can have peace of mind knowing that their funds are secure and that CM Trading adheres to strict regulatory standards.

| Regulating Authorities | Financial Services Board (FSB) |

|---|---|

| Segregated Accounts | Yes |

| Financial Audits | Yes |

Trading Platforms and Tools

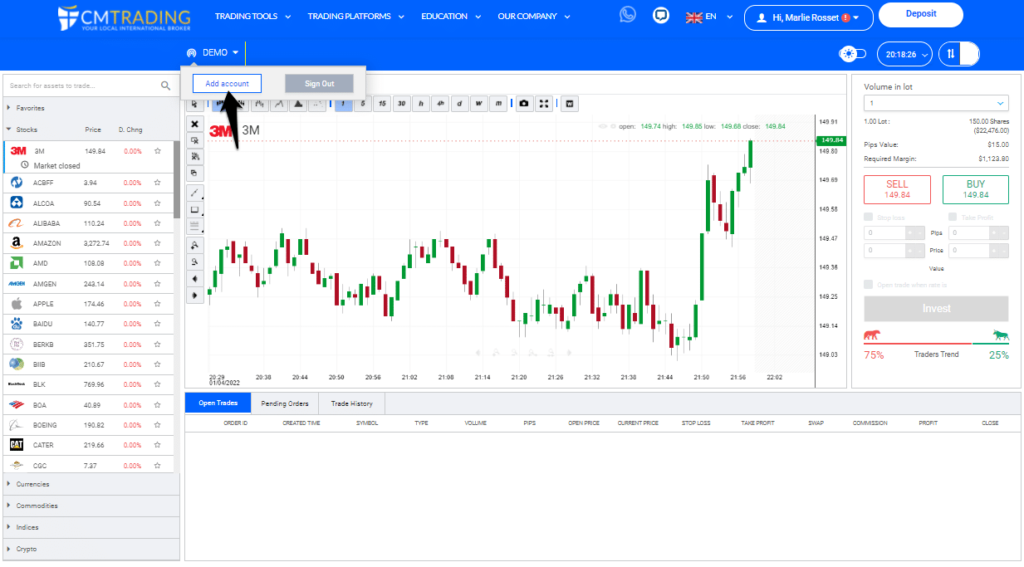

CM Trading provides traders with a variety of trading platforms, including MT4, PandaTS, and Webtrader, along with a range of useful tools to enhance their trading experience. These platforms offer different features and functionalities to cater to the diverse needs of traders.

The MT4 platform is widely recognized and preferred by traders worldwide for its advanced charting capabilities, customizable interface, and automated trading options. It allows traders to access a wide range of technical indicators, execute trades efficiently, and implement various trading strategies.

The PandaTS platform offered by CM Trading is a user-friendly web-based platform that can be accessed from any device with an internet connection. It provides traders with real-time market data, intuitive navigation, and a comprehensive set of trading tools. The platform also supports one-click trading and social trading, allowing traders to connect with other traders and learn from their strategies.

Webtrader

CM Trading’s Webtrader platform is another option for traders who prefer a web-based trading experience. It offers a simplified interface and basic trading tools, making it suitable for beginner traders. The platform provides access to real-time market quotes, charts, and news, allowing traders to make informed trading decisions.

In addition to the trading platforms, CM Trading offers a range of tools to help traders analyze the markets and execute trades more effectively. These tools include economic calendars, daily market analysis, trading signals, and educational resources. Traders can access these tools to stay updated on market trends, identify trading opportunities, and improve their trading skills.

Trading Platforms and Tools Comparison

| Trading Platform | Features |

|---|---|

| MT4 | Advanced charting, customizable interface, automated trading |

| PandaTS | User-friendly, real-time market data, social trading |

| Webtrader | Simplified interface, basic trading tools |

Overall, CM Trading provides traders with a range of trading platforms and tools to suit their individual trading preferences and strategies. Whether traders prefer the advanced features of MT4, the convenience of the web-based platforms, or the simplicity of Webtrader, CM Trading offers options for all types of traders.

Tradable Assets

CM Trading offers a wide range of tradable assets, including currencies, cryptocurrencies, CFDs, stocks, and commodities, providing traders with diverse investment opportunities. Traders can engage in forex trading and take advantage of the volatility in major currency pairs such as EUR/USD, GBP/USD, and USD/JPY. Additionally, CM Trading offers the opportunity to trade cryptocurrencies like Bitcoin, Litecoin, and Ethereum, allowing traders to capitalize on the growing popularity of digital assets.

For those looking to diversify their portfolio, CM Trading provides access to a range of CFDs (Contracts for Difference), allowing traders to speculate on the price movements of various instruments, including precious metals like gold and silver, as well as stocks, stock indexes, oil, and other commodities. This wide range of tradable assets ensures that traders have multiple options to explore and capitalize on various market trends.

| Asset Type | Example Assets |

|---|---|

| Currencies | EUR/USD, GBP/USD, USD/JPY |

| Cryptocurrencies | Bitcoin, Litecoin, Ethereum |

| CFDs | Gold, Silver, Stocks, Stock Indexes |

| Commodities | Oil, Other Commodities |

With a variety of tradable assets available on CM Trading, traders can take advantage of different market opportunities and tailor their investment strategies to their individual preferences and risk tolerance. Whether trading in major currency pairs, exploring the potential of cryptocurrencies, or diversifying their portfolio with CFDs on stocks and commodities, CM Trading provides a comprehensive trading experience for traders in South Africa.

Customer Support and Service Hours

At CM Trading, customer support is a top priority. The company prides itself on providing excellent assistance to its clients, ensuring that their trading experience is smooth and efficient. The customer support team is available during weekdays from 8am to 9pm and on Sundays from 9am to 1pm, allowing traders to get the help they need when it suits them best.

Whether you have a question about your account, need assistance with a trade, or require technical support, the CM Trading customer support team is ready to assist you. The team is multilingual, so you can communicate in English, Arabic, or Spanish, depending on your preference and comfort level.

The company understands that prompt and effective customer support is essential for traders, as it can greatly impact their trading success and overall experience. That is why CM Trading ensures that its support team is well-trained and knowledgeable, capable of addressing a wide range of queries and concerns.

| Customer Support Languages | Service Hours |

|---|---|

| English | Weekdays 8am – 9pm, Sunday 9am – 1pm |

| Arabic | Weekdays 8am – 9pm, Sunday 9am – 1pm |

| Spanish | Weekdays 8am – 9pm, Sunday 9am – 1pm |

With customer support available in multiple languages and during extended service hours, CM Trading ensures that traders have access to the assistance they need, fostering a positive and supportive trading environment.

Leverage and Account Types

CM Trading offers leverage of up to 1:200, allowing traders to potentially amplify their trading positions and maximize their potential profits. Leverage enables traders to control larger positions with a smaller amount of capital, but it is important to remember that it also increases the risk of potential losses. Traders should exercise caution and employ risk management strategies when utilizing leverage.

In addition to leverage options, CM Trading provides a range of account types to suit individual preferences and trading styles. Each account type offers unique features and benefits, catering to traders with different experience levels and investment goals.

CM Trading Account Types

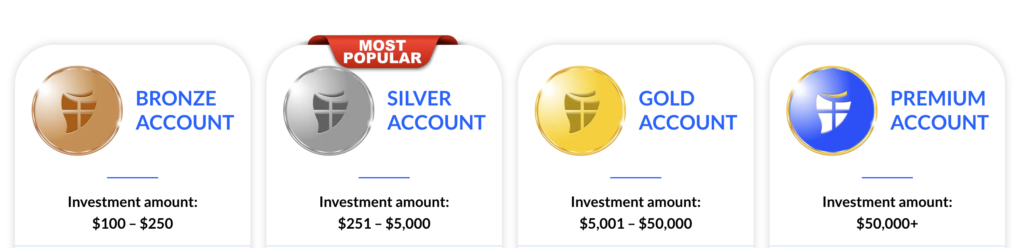

1. Bronze Account: The Bronze Account is suitable for beginner traders and requires a minimum deposit of $100 or ZAR R1,600. It offers features such as a demo account, market reviews, CM Trading eBook, webinars, regular spreads, and introduction VODs. This account is an excellent choice for those looking to get started in trading.

2. Silver Account: The Silver Account is designed for intermediate traders and requires a minimum deposit of $1,000 or ZAR R16,000. It includes all the features of the Bronze Account, along with lower spreads starting from 1.2 pips and live trading signals provided by Trading Central. The Silver Account is ideal for traders who have gained some experience and want to take their trading to the next level.

3. Gold Account: The Gold Account is suitable for advanced traders and requires a minimum deposit of $10,000 or ZAR R160,000. It offers all the features of the Silver Account, with tighter spreads, advanced webinars, and an extensive understanding of technical and fundamental analysis. Traders with a Gold Account also receive two risk-free trades. This account is designed for experienced traders who want to optimize their trading performance.

4. Premium Account: The Premium Account is the top-tier account offered by CM Trading and is tailored for professional traders. It requires a minimum deposit of $100,000 or ZAR R1,600,000. This account provides all the features and benefits of the Gold Account, including same-day withdrawals, three risk-free trades, and two trading strategies. Traders with a Premium Account also have access to VIP CMT Prepaid Cards for convenient money transactions.

| Account Type | Minimum Deposit | Key Features |

|---|---|---|

| Bronze Account | $100 / ZAR R1,600 | Demo accountMarket reviewsCM Trading eBookWebinarsRegular spreadsIntroduction VODIslamic account available |

| Silver Account | $1,000 / ZAR R16,000 | Demo accountMarket reviewsCM Trading eBookWebinarsSpreads as low as 1.2 pipsIntroduction VODIslamic account availableLive trading signals |

| Gold Account | $10,000 / ZAR R160,000 | Demo accountMarket reviewsCM Trading eBookWebinarsTighter spreadsIntroduction VODIslamic account availableAdvanced webinarsUnderstanding of technical and fundamental analysisTwo risk-free trades |

| Premium Account | $100,000 / ZAR R1,600,000 | Demo accountMarket reviewsCM Trading eBookWebinarsTighter spreadsIntroduction VODIslamic account availableAdvanced webinarsUnderstanding of technical and fundamental analysisTwo risk-free tradesTwo trading strategies |

Reviews and Testimonials

CM Trading has garnered positive reviews and testimonials from its customers, reflecting its commitment to providing an excellent trading experience. According to Trustpilot and Benzinga, reputable websites that publish customer reviews, most feedback about CM Trading is extremely positive. The company has received multiple awards and is recognized as a licensed and regulated broker, ensuring a safe and secure trading environment.

One satisfied customer on Trustpilot stated, “CM Trading offers premium analytics, extensive educational resources, and multiple trading platforms. Their social trading feature is a great addition for traders looking to learn from others’ experiences.” Another customer mentioned that CM Trading provides market reviews and a free trading eBook, enabling traders to stay informed on market trends and improve their trading strategies.

In addition to customer reviews, CM Trading has received positive assessments from industry experts. A review on Scam Broker Investigator highlights the secure trading platform, free trading signals, and the company’s license and regulation. This reinforces CM Trading’s reputation as a trustworthy broker with a commitment to transparency and client satisfaction.

Overall, the reviews and testimonials showcase the positive experiences of CM Trading’s customers. Traders have praised the company’s educational resources, multiple trading platforms, and safety measures, affirming its credibility as a reliable broker in the industry.

| Pros | Cons |

|---|---|

| – Regulated by FSCA and FSA | – Inactivity and other fees charged |

| – Segregates client funds from own funds |

CM Trading Account Types:

- Bronze Account – Minimum Deposit: $100/ZAR R1,600

- Silver Account – Minimum Deposit: $1,000/ZAR R16,000

- Gold Account – Minimum Deposit: $10,000/ZAR R160,000

- Premium Account – Minimum Deposit: $100,000/ZAR R1,600,000

CM Trading Account Features:

Each account type offers a range of features and benefits:

Bronze Account:

- Demo account

- Market reviews

- CM Trading eBook

- Webinars

- Regular spreads

- VOD introduction

- Islamic account available

Silver Account:

- Demo account

- Market reviews

- CM Trading eBook

- Webinars

- Spreads as low as 1.2 pips

- VOD introduction

- Live trading signals

Gold Account:

- Demo account

- Market reviews

- CM Trading eBook

- Webinars

- Premium spreads

- VOD advanced

- Live trading signals

Premium Account:

- Demo account

- Market reviews

- CM Trading eBook

- Webinars

- Premium spreads

- VOD expert

- Live trading signals

- Trading strategies

With a variety of account types and features, CM Trading caters to the diverse needs and preferences of traders, offering them a personalized trading experience with various benefits and tools to enhance their trading journey.

Pros and Cons

Trading with CM Trading comes with several advantages, such as being regulated by reputable authorities and offering competitive fees and spreads. The broker is licensed by the Financial Services Board (FSB) in South Africa, ensuring that it operates within strict regulatory guidelines. This provides traders with a sense of security and peace of mind, knowing that CM Trading is committed to fair and transparent trading practices.

CM Trading also offers excellent educational material, providing traders with the knowledge and resources they need to make informed trading decisions. Whether you are a new trader looking to learn the basics or an experienced trader seeking advanced strategies, CM Trading has you covered.

Additionally, CM Trading offers a range of trading platforms to suit different preferences and trading styles. From the popular MT4 platform to the user-friendly PandaTS and Webtrader platforms, traders have access to powerful tools and features that enhance their trading experience.

However, it’s important to consider some drawbacks when trading with CM Trading. One potential disadvantage is the inactivity and other fees that the broker charges. Traders should be aware of these fees and take them into account when managing their accounts to avoid any unexpected costs.

Summary:

Overall, CM Trading is a trustworthy broker that offers competitive fees, excellent educational material, and a range of trading platforms. While there are some fees to be mindful of, the advantages of trading with CM Trading outweigh the potential drawbacks. Traders can feel confident and secure in their trading experience with CM Trading, knowing that they are in the hands of a regulated and reputable broker.

| Pros | Cons |

|---|---|

| Regulated by reputable authorities | Inactivity and other fees charged |

| Competitive fees and spreads | |

| Excellent educational material | |

| Range of trading platforms |

Safety Measures and Regulations

CM Trading prioritizes the security of client funds by keeping them in segregated accounts and adhering to strict financial regulations. The company understands the importance of maintaining transparency and ensuring a fair and trustworthy trading environment for its clients.

Client funds are held in segregated accounts in reputable financial institutions, including Barclays PLC and Nedbank. This means that client funds are kept separate from the company’s own accounts, providing an extra layer of protection. It is impossible for CM Trading to use client funds for any purpose other than trading activities.

In addition to segregated accounts, CM Trading is regulated by the Financial Services Board (FSB) in South Africa. The FSB is a reputable regulatory authority that ensures compliance with financial regulations and promotes fair and transparent trading practices. The company follows the regulatory guidelines set by the FSB to provide a safe and secure trading environment for its clients.

By adhering to stringent safety measures and regulations, CM Trading demonstrates its commitment to protecting client funds and maintaining the integrity of the financial markets. Traders can have peace of mind knowing that their funds are secure and that they are trading with a trusted and regulated broker.

| CM Trading Safety Measures and Regulations | |

|---|---|

| Client Funds | Segregated accounts in reputable financial institutions |

| Regulatory Authority | Financial Services Board (FSB) |

“CM Trading prioritizes the security of client funds and adheres to strict financial regulations to provide a safe and transparent trading environment.” – CM Trading client

Conclusion

In conclusion, CM Trading is committed to ensuring the safety and security of client funds. By keeping client funds in segregated accounts and adhering to strict financial regulations, the company provides a transparent and trustworthy trading environment. Traders can trade with confidence knowing that their funds are protected and that they are trading with a regulated broker.

Account Types and Features

CM Trading offers multiple account types, each with its own set of features and benefits, catering to the diverse needs of traders. Whether you are a beginner or an experienced trader, CM Trading has an account type that suits your trading style and preferences. Here are the different account types available:

Bronze Account

The Bronze Account is the entry-level account, requiring a minimum deposit of $100 or ZAR R1,600. This account offers features such as a demo account, market reviews, CM Trading eBook, webinars, regular spreads, and an introduction to the video-on-demand (VOD).

Silver Account

The Silver Account requires a minimum deposit of $1,000 or ZAR R16,000. In addition to the features offered in the Bronze Account, the Silver Account provides lower spreads, live trading signals, and access to the Guardian Angel system, which provides feedback on trading performance.

Gold Account

The Gold Account is designed for traders with a minimum deposit of $10,000 or ZAR R160,000. Along with the features of the Bronze and Silver Accounts, the Gold Account offers even lower spreads, access to advanced webinars, advanced VOD, and a personal account manager.

Premium Account

The Premium Account is the highest tier account, requiring a minimum deposit of $100,000 or ZAR R1,600,000. Traders with a Premium Account enjoy all the features of the lower-tier accounts, as well as additional risk-free trades, exclusive trading strategies, and same-day withdrawals.

CM Trading’s account types provide traders with flexibility and options to choose the account that best suits their trading needs, from beginners looking for educational resources to experienced traders seeking advanced features and personalized support.

| Account Type | Minimum Deposit (USD) | Minimum Deposit (ZAR) |

|---|---|---|

| Bronze Account | $100 | ZAR R1,600 |

| Silver Account | $1,000 | ZAR R16,000 |

| Gold Account | $10,000 | ZAR R160,000 |

| Premium Account | $100,000 | ZAR R1,600,000 |

Leverage and Trading Conditions

CM Trading offers competitive leverage options and favorable trading conditions, allowing traders to optimize their trading strategies while managing risk effectively. With a maximum leverage of 1:200, traders can access larger positions in the market with a smaller initial investment. This can potentially lead to higher profits, but it’s important to note that leverage also increases the potential for losses.

The trading conditions at CM Trading are designed to cater to the needs of both beginner and experienced traders. The broker offers a range of account types, including a Mini Account with a minimum deposit of $250 and a Classic Account with a minimum deposit of $1,000. Each account type comes with different features and benefits, such as access to webinars, market reviews, and risk-free trades.

In terms of spreads, CM Trading offers competitive rates, with the specific spread depending on the chosen account type and trading instrument. Traders can expect tight spreads on major currency pairs, ensuring cost-effective trading. Additionally, CM Trading provides access to a variety of trading tools and platforms, including the popular MetaTrader 4, Sirix Web Trader, and CopyKat, which allows traders to copy the trades of successful traders.

| Account Type | Minimum Deposit | Leverage | Spreads |

|---|---|---|---|

| Bronze Account | $250 | 1:200 | Regular |

| Silver Account | $1,000 | 1:200 | As low as 1.2 pips |

| Gold Account | $5,000 | 1:200 | Tight spreads |

| Premium Account | $25,000 | 1:200 | Tight spreads |

It is important for traders to carefully consider their risk tolerance, trading goals, and financial situation before choosing an account type and leveraging their positions. Proper risk management strategies, such as setting stop-loss orders and limiting the size of trades, should be employed to protect against potential losses and ensure long-term success in the financial markets.

Funding Methods and Withdrawals

CM Trading offers a range of secure and convenient funding methods, including wire transfers, debit/credit cards, and popular e-wallets, ensuring smooth and hassle-free transactions. Traders can choose the method that suits their preferences and needs, providing flexibility and accessibility.

Wire Transfers: This traditional method allows traders to transfer funds directly from their bank accounts to their CM Trading trading accounts. It provides a secure and reliable way to deposit and withdraw funds.

Debit/Credit Cards: CM Trading accepts major debit and credit cards, providing a convenient way for traders to fund their accounts instantly. This method is widely used and trusted by traders worldwide.

E-wallets: CM Trading supports popular e-wallets such as Skrill, Neteller, and Mpesa, enabling traders to transfer funds quickly and securely. E-wallets offer a convenient way to manage funds and make transactions online.

Complete Table of Funding Methods and Withdrawals

| Funding Methods | Withdrawal Options |

|---|---|

| Wire Transfers | Wire Transfers |

| Debit/Credit Cards | Debit/Credit Cards |

| E-wallets (Skrill, Neteller, Mpesa) | E-wallets (Skrill, Neteller, Mpesa) |

By offering a variety of funding methods, CM Trading ensures that traders have options to suit their individual preferences and needs. The secure and convenient nature of these methods makes it easy for traders to deposit and withdraw funds, providing peace of mind in their trading journey.

Conclusion

In conclusion, CM Trading is a trustworthy broker that provides a safe and transparent trading environment for traders in South Africa. With its headquarters in Johannesburg and regulation by the Financial Services Board (FSB), CM Trading demonstrates its commitment to operating within strict guidelines and ensuring the security of client funds.

CM Trading offers competitive fees and spreads, making it an attractive option for traders looking to maximize their investment returns. The broker also provides excellent educational material, including webinars and a comprehensive eBook, to help traders enhance their trading skills and make informed decisions.

Traders on CM Trading have access to a wide range of tradable assets, including currencies, cryptocurrencies, CFDs, stocks, and commodities. The broker offers multiple trading platforms, such as MT4, PandaTS, and Webtrader, to cater to different trading preferences.

Customer support is a priority for CM Trading, with dedicated support available in English, Arabic, and Spanish. Support is accessible during weekdays from 8 am to 9 pm and on Sundays from 9 am to 1 pm. Traders can reach out to the customer support team via live chat, email, or international phone numbers.

In summary, CM Trading is a reliable and reputable broker that offers a secure and convenient trading experience for traders in South Africa. With its comprehensive range of account types, trading conditions, and educational resources, CM Trading is a trusted choice for both beginner and experienced traders.

FAQ

Q: Is CM Trading a trustworthy broker?

A: CM Trading has a high trust score of 91 out of 99 and can be considered a low-risk trading platform. Client funds are held in segregated accounts to ensure maximum security and peace of mind.

Q: What are the account types offered by CM Trading?

A: CM Trading offers four account types: Bronze Account, Silver Account, Gold Account, and Premium Account. Each account has its own minimum deposit requirement and offers different features and benefits.

Q: What trading platforms does CM Trading provide?

A: CM Trading offers three trading platforms: MT4, PandaTS, and Webtrader. These platforms are compatible with desktop (Windows and Mac), web, and mobile (Android and iOS) devices.

Q: What tradable assets are offered by CM Trading?

A: CM Trading offers a wide range of tradable assets, including currencies, cryptocurrencies (Bitcoin, Litecoin, Ethereum), CFDs (Gold, Silver, Other Precious Metals), Stocks, Stock Indexes, Oil, and Other Commodities.

Q: What are the customer support hours at CM Trading?

A: Customer support at CM Trading is available on weekdays from 8am to 9pm and on Sunday from 9am to 1pm. Support is offered in English, Arabic, and Spanish.

Q: What are the pros and cons of trading with CM Trading?

A: Pros of trading with CM Trading include being regulated by FSCA and FSA, offering institutional and managed accounts, and segregating client funds from company funds. Cons include inactivity and other fees charged.

Q: What safety measures and regulations are in place at CM Trading?

A: CM Trading is regulated by the Financial Services Board (FSB) and follows stringent regulatory guidelines to ensure a fair and transparent marketplace. Client funds are held in segregated accounts in reputable banks, and routine audits ensure fair and honest financial dealings.

Q: What are the funding methods and withdrawal options available on CM Trading?

A: CM Trading offers a variety of funding methods, including Visa card, MasterCard, Bank Wire, EFT, OZOW, Skrill, Neteller, Mpesa, Local Mobile Money, and Cryptocurrencies. Withdrawals can be made through Visa card, MasterCard, Bank Wire, OZOW, Skrill, Neteller, Mpesa, Local Mobile Money, and Cryptocurrencies.

Q: Is CM Trading suitable for new traders?

A: CM Trading offers educational material, a demo account, and a variety of account types suitable for new traders. Their customer support team is also available to assist new traders with any questions or concerns.

Q: Can I trade with CM Trading if I am based in the United States?

A: Unfortunately, CM Trading is not available to traders based in the United States. However, it is open to traders from other countries.

Q: Can I open an Islamic account with CM Trading?

A: Yes, CM Trading offers an Islamic account option, also known as a swap-free account, for traders who follow Islamic principles and wish to avoid interest charges.